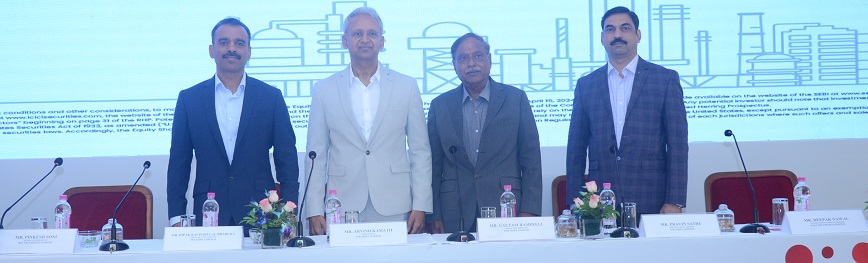

JNK India Limited’s IPO to open on Tuesday, April 23rd

2 min read

Mumbai/Kolkata: JNK India Limited is in the business of manufacturing the process-fired heaters, reformers, and cracking furnaces (together, the “Heating Equipment”) that are required in process industries such as for oil and gas refineries, petrochemical and fertilizer industries, has fixed the price band of ₹395/- to ₹415/- per Equity Share of face value ₹2/- each for its initial public offer.

The Initial Public Offering (“IPO” or “Offer”) of the Company will open on Tuesday, April 23rd, 2024, for subscription and close on Thursday, April 25th, 2024. Investors can bid for a minimum of 36 Equity Shares and in multiples of 36 Equity Shares thereafter.

The issue consists of a fresh issue of ₹3,000.00 million and offer for sale (OFS) of up to 8,421,052 Equity Shares from promoter selling shareholders and individual selling shareholder.

The Company have capabilities in thermal designing, engineering, manufacturing, supplying, installing, and commissioning heating equipment and caters to both domestic and overseas markets.

Over the years the Company has diversified into flares and incinerator systems and have been developing capabilities in the renewable sector with green hydrogen. The Heating Equipment are required in process industries such as oil and gas refineries, petrochemicals, fertilizers, hydrogen and methanol plants etc.

As of December 31, 2023, it has served 21 customers within India 8 customers overseas. In India, it has completed projects in, amongst others, Andhra Pradesh, Assam, Bihar, Karnataka, Kerala, Maharashtra, Tamil Nadu, West Bengal and globally have completed projects in Nigeria and Mexico.

Further, it has ongoing projects in Gujarat, Odisha, Haryana, Rajasthan in India and globally in Oman, Algeria, and Lithuania. Further, it has successfully completed projects in far-reaching locations which included projects in India at Numaligarh, Assam; Kochi, Kerala; Barauni, Bihar; and overseas at Lagos, Nigeria.

The Offer is being made through the Book Building Process, wherein not more than 50% of the Offer shall be available for allocation to Qualified Institutional Buyers, not less than 15% of the Offer shall be available for allocation to Non-Institutional Investors and not less than 35% of the Offer shall be available for allocation to Retail Individual Investors.