8th Eastern India Microfinance Summit 2024 to be held on February 22

2 min read

Kolkata: The Association of Microfinance Institutions – West Bengal (AMFI-WB) has announced to organize the 8th Edition of Eastern India Microfinance Summit 2024 in Association with M2i, Equifax, MFIN & Sa-Dhan.

This year the theme of the Summit “Empowering the poor: Microfinance as a Catalyst for Sustainable Development”. The 8th Eastern India Microfinance Summit 2024 will be held on 22nd February 2024 from 9AM onwards at Biswa Bangla Convention Centre.

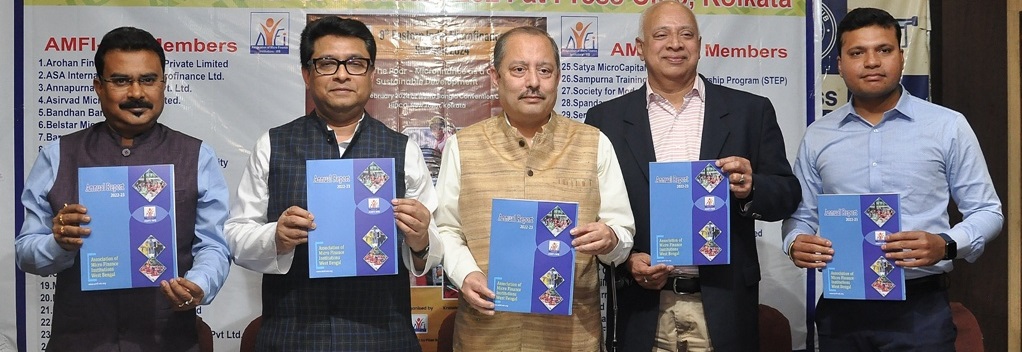

Dr. Alok Misra, CEO & Director, MFIN; Kuldip Maity, MD & CEO, VFS Capital Ltd and Secretary, AMFI-WB; Manoj Nambiar, MD, Arohan Financial Services Ltd.; Kartick Biswas, MD, Uttrayan Financial Services Pvt. Ltd. along with other representatives of AMFI-WB were present to brief the media about the Summit at the Press Conference at Kolkata Press Club.

This year the Summit is expecting over 400 Leaders and senior officials from MFIs (NGOs as well NBFCs, SFBs, BCs and Bank) which are operating in West Bengal, Odisha, Jharkhand, Bihar and North Eastern States. The Summit is expecting over 60 MFIs from Eastern India.

It aims to bring together the national and global community of stakeholders, particularly lenders and Investors, to discuss current and future aspects of financial inclusion, and how Microfinance plays an important role as a Catalyst for a Sustainable Development of the society.

The Summit will witness Delegates from Bangladesh and Nepal; Banks, Regulators, Ratings Agencies; Fintech, IT, Software Companies; Insurance Companies; Researchers, Scholars and Students; Energy Companies especially green energy providers and social enterprises.

The Summit will also have Mobile Banking/Core Banking Solution Providers; Industry association/network; Donor agencies/multilateral Institutions and International Agencies; Consultancy firm, among others stakeholders.

Microfinance is widely recognized as a powerful tool, contributing to and propelling towards achieving sustainable development goals. Its multifaceted roles encompass some of the key aspects instrumental in fostering sustainable development.

Through financial inclusion, microfinance democratizes access to capital, empowering marginalized communities and amplifying economic participation. It contributes to poverty alleviation, offering avenues for entrepreneurship and job creation.

Microfinance also champions gender equality by providing women with access to financial services. As a catalyst for change, microfinance intertwines financial empowerment with social empowerment, paving the way towards a more inclusive and sustainable future.

This year’s session is expected to be attended by the MFIs practitioners, regulators and funders to discuss most pertinent issues facing the sector.